The Complete Due Diligence Platform

Everything you need to streamline your investment process, from initial screening to portfolio monitoring.

End-to-End Investment Workflow

We offer a comprehensive solution across the full investment lifecycle, from initial research to final exit.

Research & Setup

Initial market research and investment framework establishment

Deal Sourcing

Identify and evaluate potential investment opportunities

Due Diligence

Comprehensive analysis and risk assessment of targets

Investment Decision

Final evaluation and investment committee approval

Portfolio Management

Active monitoring and value creation initiatives

Performance Tracking

Regular assessment of investment performance metrics

Exit Strategy

Planning and execution of investment exit opportunities

Returns Distribution

Distribution of proceeds to investors and stakeholders

Reporting & Analysis

Comprehensive reporting and performance analysis

Data Archive & Knowledge Management

Systematic storage and knowledge capture for future investments

Research & Setup

Initial market research and investment framework establishment

Deal Sourcing

Identify and evaluate potential investment opportunities

Due Diligence

Comprehensive analysis and risk assessment of targets

Investment Decision

Final evaluation and investment committee approval

Portfolio Management

Active monitoring and value creation initiatives

Performance Tracking

Regular assessment of investment performance metrics

Exit Strategy

Planning and execution of investment exit opportunities

Returns Distribution

Distribution of proceeds to investors and stakeholders

Reporting & Analysis

Comprehensive reporting and performance analysis

Data Archive & Knowledge Management

Systematic storage and knowledge capture for future investments

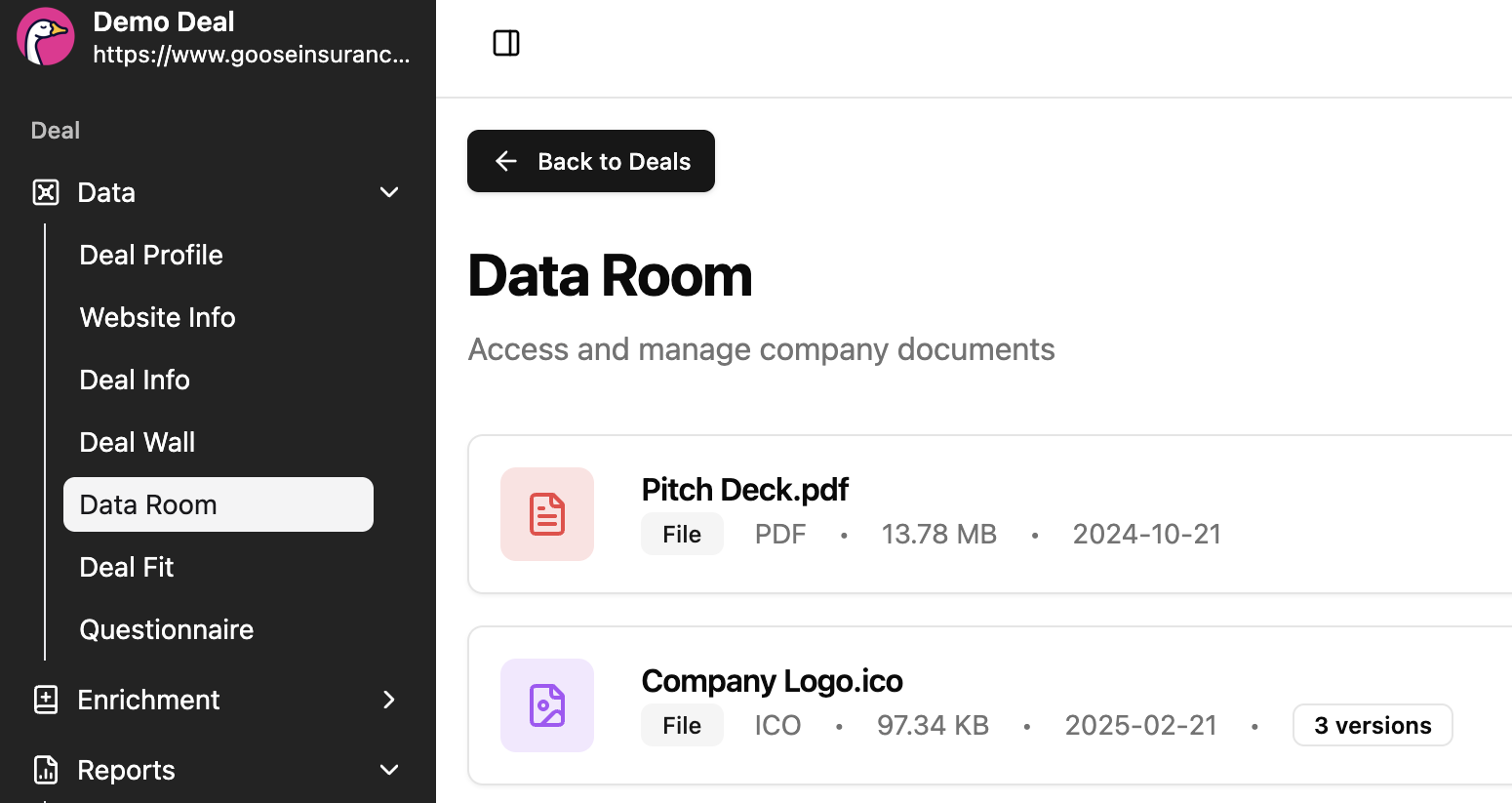

Document Extraction

Automatically extract key metrics and data points from pitch decks and data rooms

Key Capabilities

- OCR and NLP processing

- Different file types

- Data room management

- Bulk upload

- Automatic table & key-value extraction

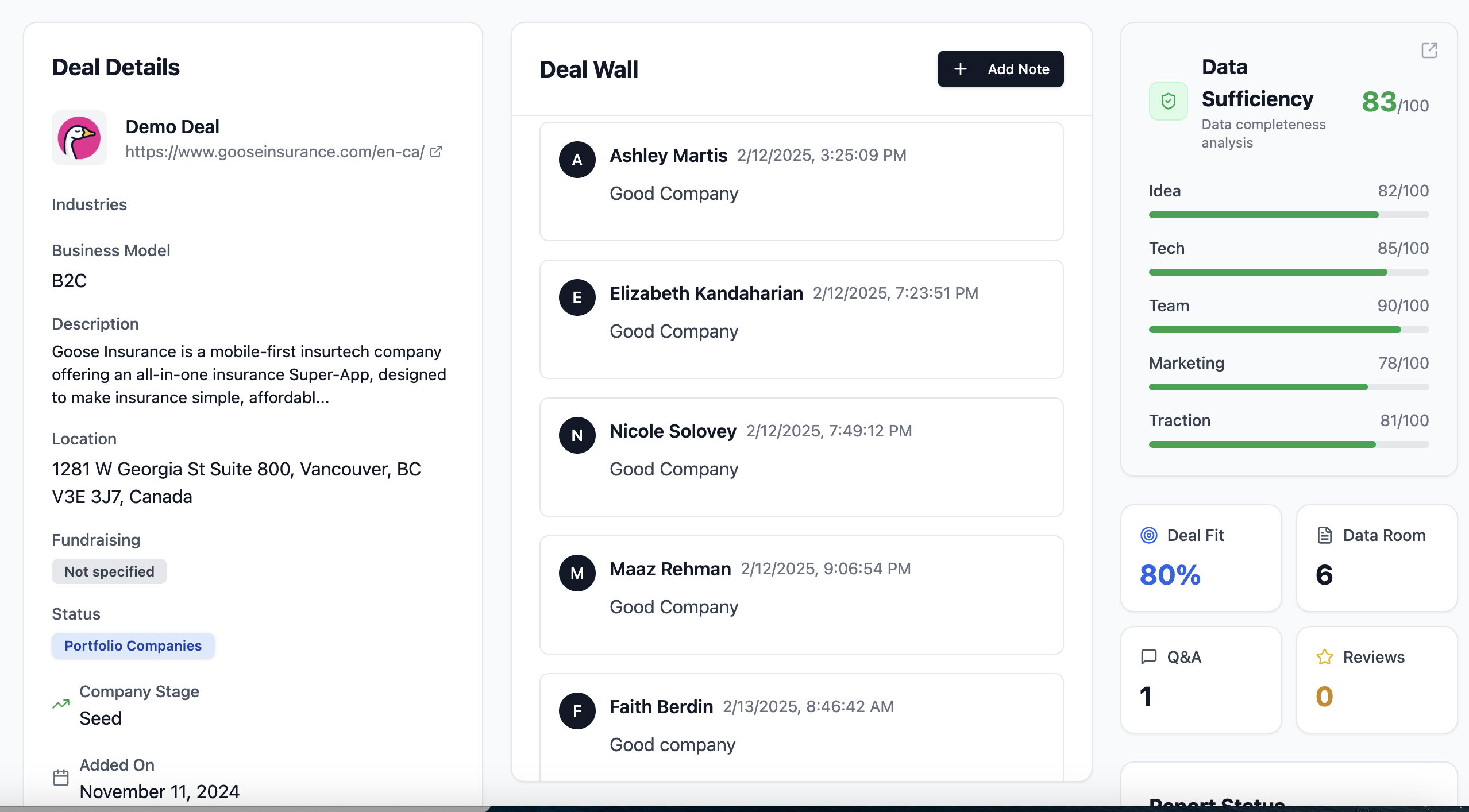

Deal Management

Streamlined deal pipeline management with automated workflows, status tracking, and team collaboration tools for efficient investment processes.

Key Capabilities

- Deal pipeline visualization

- Automated workflow management

- Status tracking and updates

- Team collaboration tools

- Integration with CRM systems

Benchmarking System

AI-powered scoring system with detailed breakdown and rating analysis. We have updated our benchmarking system to improve cross-market comparability.

Key Capabilities

- Overall deal scoring algorithm

- Detailed score breakdowns

- Industry and stage categorization

- Performance tracking over time

- Comparative analysis tools

Valuations

Multi-method valuation with probabilistic outputs. Shows low/median/high ranges and distribution so you can reason about uncertainty.

Key Capabilities

- Score Card Method analysis

- DCF modeling capabilities

- Comparables method

- VC Exit method

- Probabilistic distribution curves

Market Intelligence

On-demand market sizing and segment context (TAM/SAM), with tags and drivers extracted for quick diligence.

Key Capabilities

- Total Addressable Market analysis

- Serviceable Addressable Market sizing

- Market drivers identification

- Segment context analysis

- Growth potential assessment

Portfolio Company Management

Track companies, risk labels, and category scores at a glance. Sort, search, and export views.

Key Capabilities

- Company portfolio dashboard

- Risk assessment tracking

- Category scoring system

- Advanced filtering and sorting

- Export capabilities

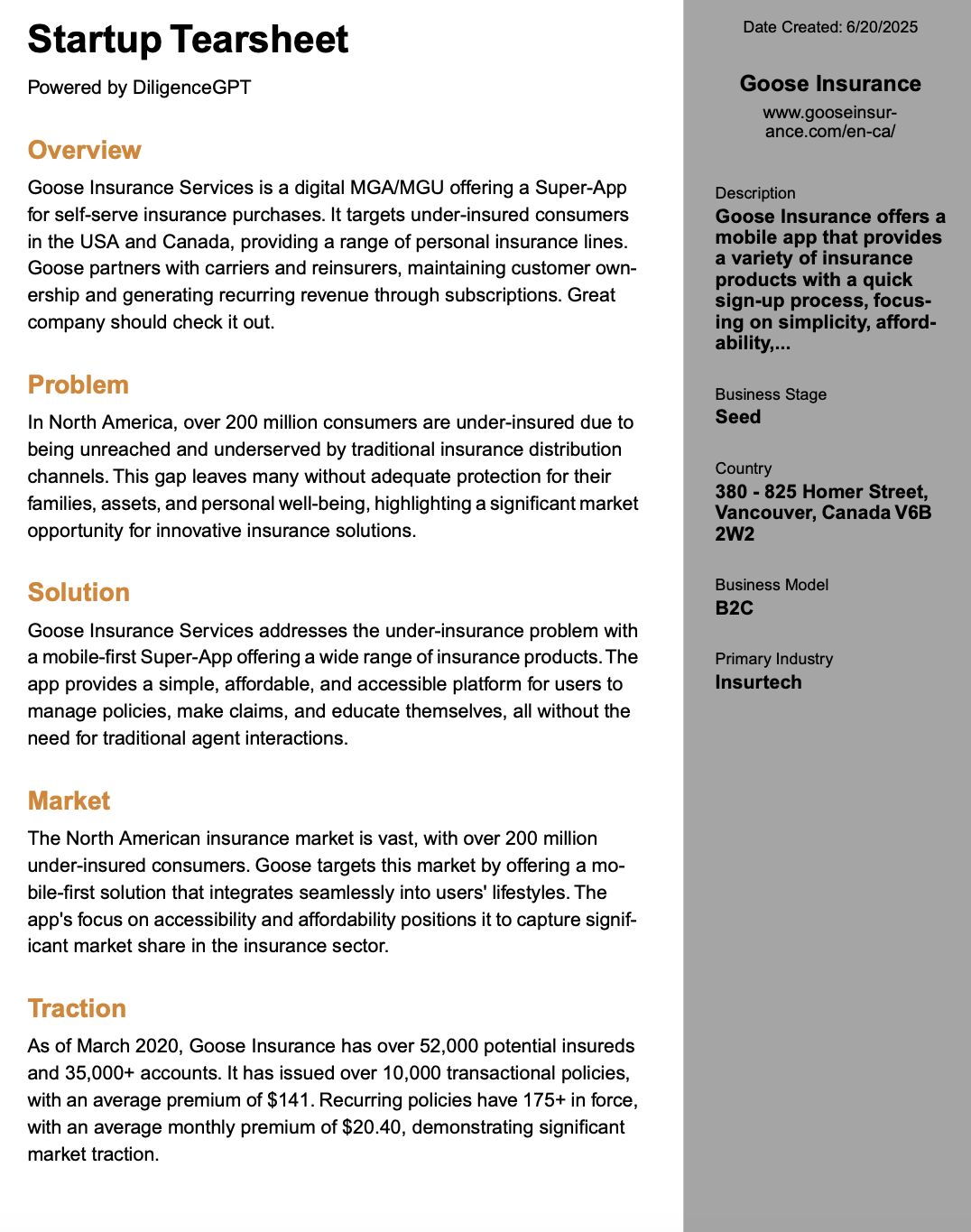

Tear Sheets

Generate comprehensive startup evaluation reports with detailed analysis sections. Trained on 10,000+ VC and P/E tear sheets. High accuracy with strong reasoning to justify outputs.

Key Capabilities

- Comprehensive company overview

- Problem and solution analysis

- Market opportunity assessment

- Traction and metrics tracking

- Professional report formatting

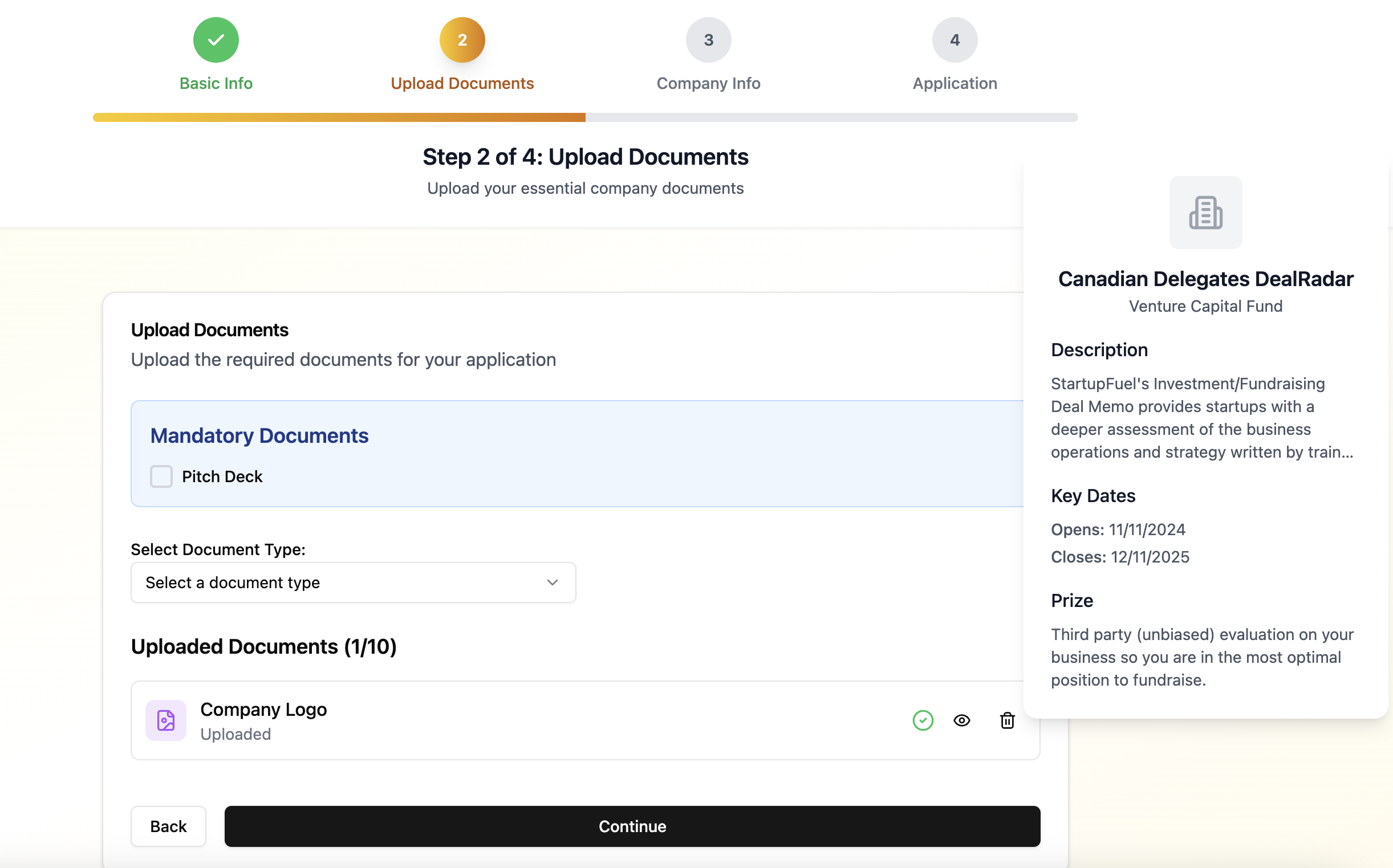

Data Intake

Streamlined application process with guided workflows and document management. Supports a unique URL for a portal page with company-specific intake details.

Key Capabilities

- Multi-step application workflow

- Document upload and validation

- Progress tracking and status updates

- Automated deal creation

- Integration with deal pipeline

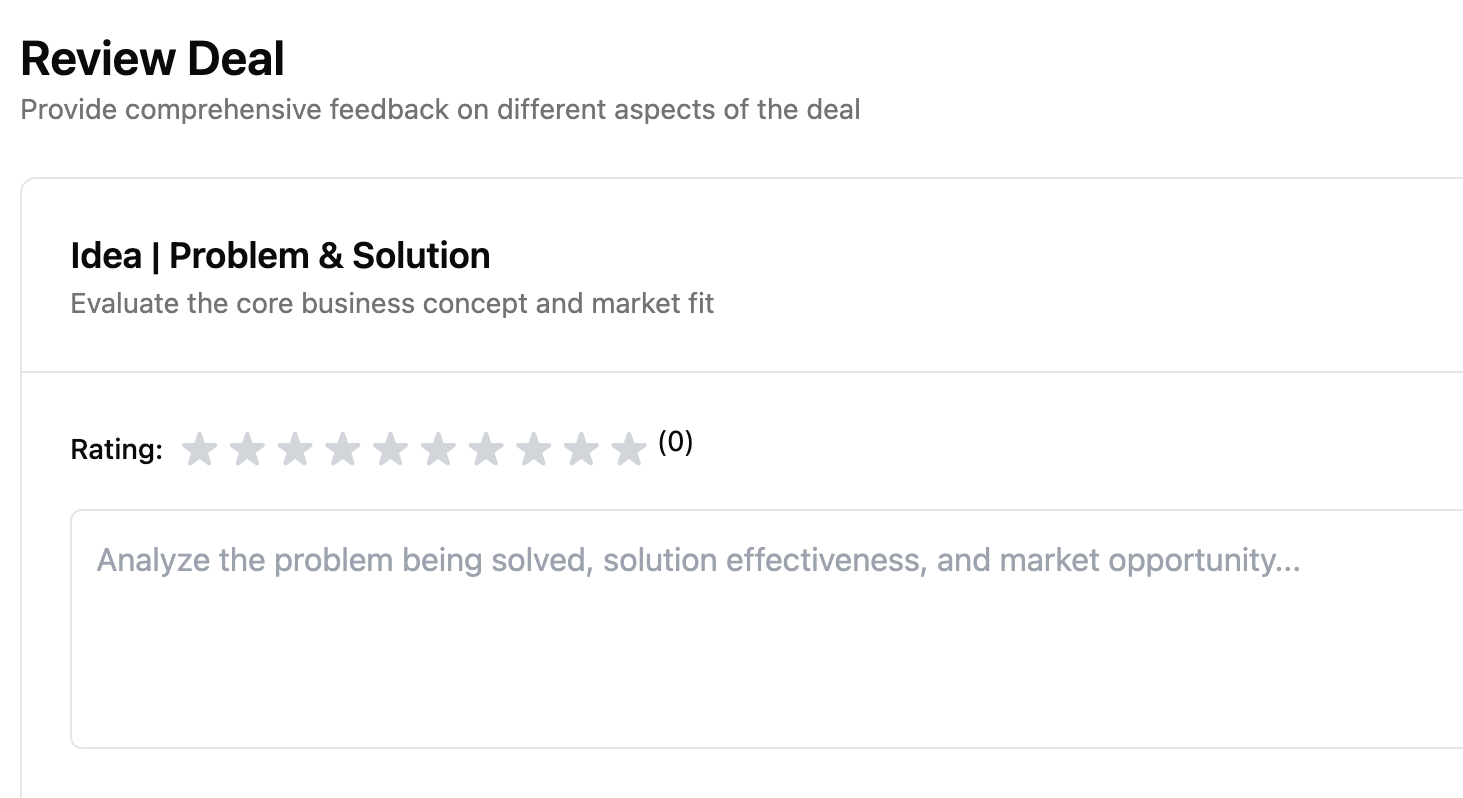

Team Reviews

Collaborative deal evaluation with structured team feedback and consensus building. Internal reviewers and external stakeholders (e.g., LPs) can securely view and contribute feedback.

Key Capabilities

- Structured review workflows

- Star rating system for deal aspects

- Team collaboration tools

- Consensus building features

- Review history tracking

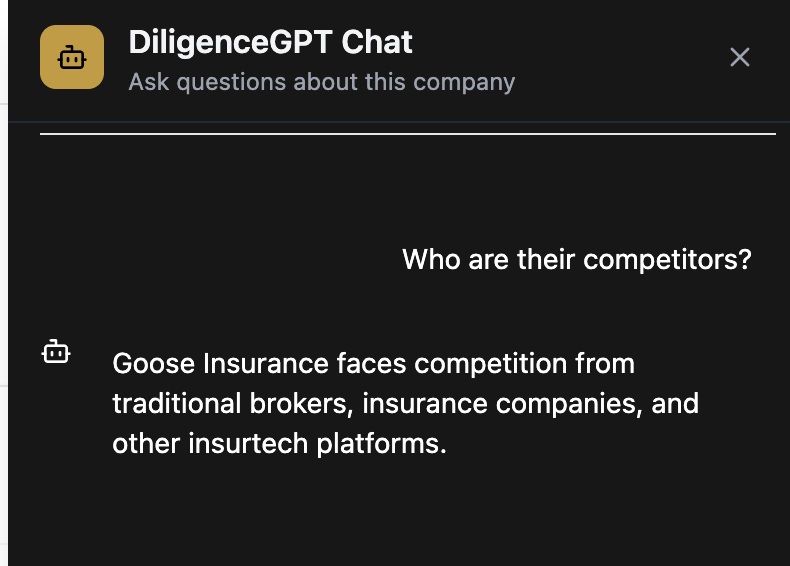

Deal Chat

Interactive AI assistant to answer questions about any deal in your pipeline. Very speedy answers and you can chat with your data room (documents and extracted fields).

Key Capabilities

- Natural language queries

- Deal-specific insights

- Document Q&A

- Comparative analysis

- Smart recommendations